![]()

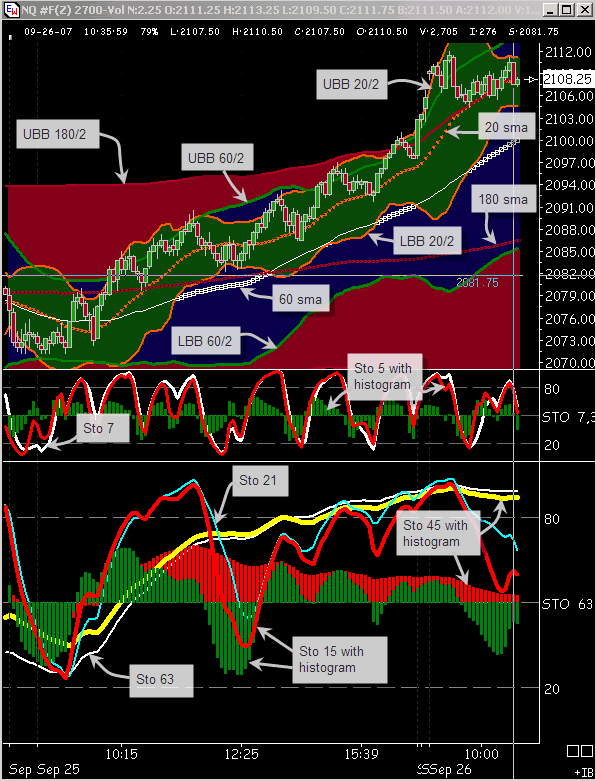

This template is the cornerstone of a trading system using basic indicators of Bollinger Bands and stochastics. These are utilized in unique ways to clearly see where the buying and selling pressures exist. Three time frames are represented on the template both in the Bollinger Bands and in the stochastics which provide a quick visual of short term to long term support and resistance. These are in multiples of 3s and show the cycles of price ebb and flow. Watch the relationships at turns. The bottom window becomes the next higher time frame fast window (middle window). The template can be used for both scalping, intraday swings and longer term trades and for stocks, options and commodities as well as futures.

For U.S. index futures, the workspace comprises at least 3 charts representing different time frames (in terms of volume). The entry / exit decisions are primarily based on the “main time frame”. The higher time frame provides the context and larger trend and the lower time frame gives information to fine tune the trade. The optimum time frames are as follows given as volume charts:

| Instrument | Lower TF | Main TF | Higher TF | Higher + | Higher ++ |

| ES | V1821 | V5463 | V16389 | V49167 | |

| NQ | V900 | V2700 | V8100 | V24300 | V72900 |

| YM | V233 | V700 | V2100 | V6300 | V18900 |

| ER2 | V233 | V700 | V2100 | V6300 | V18900 |

These settings have been proven to give the clearest and most consistent results for these instruments.

The colors used in this template are those preferred by its author. Of course you are free to change the colors as you wish; however keep in mind that the Sto 5 and Sto 15 lines and their histograms are key to this approach. They are colored strongly for that reason. Also note that the 60sma (also referred to as the “middle band”) in the chart window should be emphasized as shown. The Simple Cycles system will be easiest to utilize if these stand out as seen on the chart image below.

Another important aspect to this template is the proportion of the different panels. The price panel (termed “chart window” in ensign) should take up the top 50%. The bottom panel (“sub-window 2” in ensign) should be 75% or so of the bottom 50%. The middle panel (“sub-window 1” in ensign) should be proportionally the size of the chart image shown below. Laying out the template in this way optimizes its ease of use.

Abbreviations in the chart:

| UBB - Upper Bollinger Band | Sto - stochastic |

| LBB - Lower Bollinger Band | sma - simple moving average |

Last updated 09/28/2007